How To Avoid Paying Debt Collectors

In this down economy, with more and more people facing for closures and bankruptcy, business is booming for collection agents, skip tracers and repo men.

Assuming that there is nothing at the moment you can do to address your debts, the practical alternative is to avoid them and at the same time, buy some time and save yourself the unnecessary added stress of their constant harassment.

When it comes to peace of mind, sometimes you got to do what you have to to get it.

And before someone goes on a rant that anyone who owes money deserves whatever harassment that they get--remember that there are tons of fake collection scams, zombie debt and other related fraud. Is it huge nowadays, so it could be that you are getting calls from debt collectors without owing anyone a dime!

Debt Collectors Tactics

Debt collectors sometimes use threats to pressure people into paying a debt. These include threatening to arrest you, garnish your wages or bank accounts, or sue you.

Collection agencies also harass you by calling neighbors and family members and make harassing phone calls, calling calling you at bad times such as dinner, weekends, or holidays, calling outside the hours of 8 a.m. to 9 p.m and calling you at work or using obscene language.

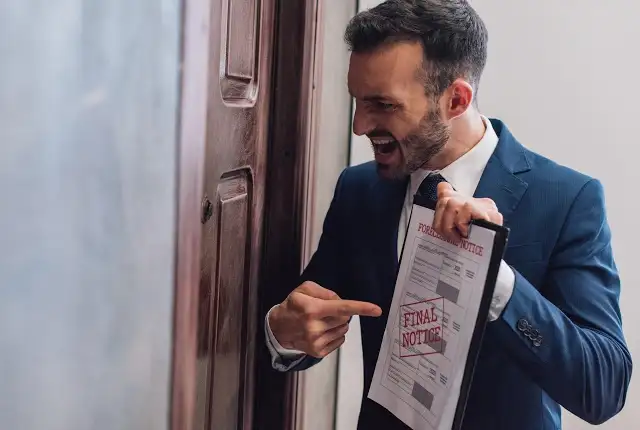

These bill collectors are also often using illegal tactics like threats, calling one's place of work and harassing the debtor, and sending fake "official" looking documents.

They buy debt from credit card companies, utilities and other companies, and then try to get consumers to pay it back along with fees and penalties, mostly using questionable tactics.

Collection agencies sometimes hire lawyers to send out thousands of real looking but fake draft statements of claim with cover letters, all of which which look exactly like a court judgement, tricking the debtor into compliance.

They fool most debtors as they have an official looking letterhead and red notary seal. Good thing is the law is cracking down on these guys, and some of the lawyers risk being disbarred. An example of the kind of things they do:

If you are leaving any substantial degree of debt, it is a matter of time before your phone starts ringing dozens of times a day. If you have a vehicle or boat, then there are also the repo men that will eventually show up.

There are many ways that debt collectors can find us - some pretty self evident and some not so.

How Debt Collectors Find You

Telephones and Directories

The main weapon that bill collectors have is the telephone. The most common thing you will face are harassing bill collector calls. I am stating the most obvious, never ever have a phone in your name.

Never ever return a call to a collection agent from your own phone. Using *67 to block your number will not work when calling a 1-800 number, and, quite often they will leave a local number that redirects to a toll-free number to phish out your number.

The way to deal with this is to get an anonymous, pre-paid cell phone and if you must return their calls, use one of those cheap pre-paid calling cards for $5 or $10 as an extra layer of protection.

That will frustrate their attempts. If they ask for your number, say that you do not have a phone and are calling from a public phone. Never ever use a friend, ex spouse or family member's phone to call these people either.

Also make sure that if you are changing phone providers, it might not be enough to make the new number an unpublished one, as online directories will sometimes fly under the radar and list your new phone regardless.

I know of cases where this has happened; the client is charged by the phone company $5 a month for an unlisted number and then some other company's directory lists the number anyway!

If you are going to insist on getting a landline phone, use a different name. If your name is, say, "John Edward Smith", tell the new phone company that your name is "Ed Smith" or "John Edward".

This trick works most of the time. The first example is likely the best, because if anyone questions it, just say that you have always used your middle name as your first name. Who is to know otherwise?

You can use any one of a number of Online VoIP Internet phone services. These are very cost efficient options. Another option is to use a combination of Google Hangouts and Skype.

In either case, find an alternate way of paying for it, other than any form of payment that can leave a paper trail back to you.

If they have a hunch where you live, they can use a reverse directory to cross-reference your neighbors and grill them if they know you. Also, it goes without saying, be very careful of who you give the number to. Many companies, like utilities, retailers and credit card companies sell your data!

What Happens When Debt Collectors Call?

One reader from Canada advised me that what happened to her is that the bill collection people were actually spoofing the number on the call display. She had owed money on her Visa card which went into collections.

After ignoring the collection's calls or hanging up on them, they tried a new tactic - making the number on the call display show up as "Bell Canada - 1-877-866-8880" - the main phone and Internet provider in Canada.

The bill collector's were betting that there is a high chance that she actually used that provider for telecom services, since there are only three big telecoms in Canada (Bell, Rogers and Telus).

Sneaky or what? Be very careful and always mindful of the lows these people will go to to find you!

Stop Harassing Calls From Debt Collectors

As mentioned, it is no common for bill collectors to spoof their numbers to trick you into answering the phone. If you have an Android cell phone, there is an app called Call Control to block them.

This app can block any last number that called you, whole area codes (like 800 numbers) and anonymous.

Besides blocking unknown and anonymous callers, the Call Control call blocker app for Android automatically blocks calls from spammers and robocallers. If a debt collector calls you, just add their number to Call Control! Get it at Google Play store.

Using Mail And Postal Services

If they do get you address and send you mail, be careful of return addresses. Best to use a "mail drop" or "mail forwarding service" like MyRVMail. They offer several street addresses which you can have mail and parcels forwarded for you.

Bill collectors receive notification of your Earth Class Mail address which will confuse them where you are really residing. The service offers a web-based interface from which to manage your mail.

You can have certain packages forwarded to certain addresses and others to other locations or even issue a directive to have any mail shredded. You forward your mail, in real time with a mouse click. The service costs around $20 a month, which is not much for added peace of mind.

Your Credit Report and Tax Information

In most cases, you are the most vulnerable by the info that the various credit bureaus give out to collection agencies. Then there is the IRS (or in Canada, the CRA) who, if you filed your income taxes or got a tax return, will have your address among other things to offer the bill collectors.

If you must file for an income tax return, make sure to not offer your real address or phone number. In the case of the credit bureau, it is best to obtain a consolidated copy of your credit report and update your new, decoy telephone and address with them.

This will update the info with all of the main credit bureaus, who in turn will feed the collections people bogus information, which will buy you time.

Note: whenever you open a new bank account, there is immediately an inquiry listing made into your credit bureau report, since the bank or financial institution will assign a credit score for you, as they want to sell you credit products and loans etc.

Collection agencies will use this as a lead to where you are banking. Utilities and other accounts show up in the credit report too, so these kinds of things give the debt collectors leads as your private details.

Finding You Through Public Records

Another liability is the public records database, which can be an issue if you own any property, boats or vehicles. One of their tricks is to keep checking the DMV records of parking tickets.

If you get a parking ticket, it may list your home phone or address, so be careful again of what information you offer authorities. Something else you want to avoid is having any utilities in your name - cable TV, hydro, gas, etc can all lead bill collectors to you if you are not careful.

So, again, use a variation of your real name or get the utilities listed in a trusted friend's name.

Family, Friends, Ex's, Employers and Neighbors

Again, be careful of to whom you reveal your personal contact information to. I wouldn't want to know who many people had a repo man snatching their car who found their address from a vindictive ex-spouse or "friend".

How To Avoid Paying Debt Collectors?

In most states (and Provinces in Canada) there are statutes of limitations, or limitations acts.

These stipulate how long the debt can stay on your record, but more importantly, they specify a deadline after which they collector can no longer garnish your wages, seize assets or act on a notice of claim (as long as you do not "acknowledge the debt", more about that in a bit).

For example, in some states and provinces it is two years. What that means is that after two years from when the debt began or whenever you acknowledge the debt, they cannot come after your asserts, although they can still continue to call and harass you.

What is meant by acknowledging the debt is that the collections agents will do whatever it takes to get you to admit to owing the money - that the debt is legitimate.

For example, they will try to trick you into agreeing to send them a small payment to "give you a break" and get you to do this by sending them a cheque.

Once you've done that, they will know based on the numbers on the cheque where you are banking - in other words, they will know which bank to file a claim against.

Whatever you do, never ever acknowledge the debt. They will threaten to sue you, harass you, but once this period has expired, they will be unable to collect.

Can They Collect?

In some cases, especially in these times, you might actually be "judgment proof". If you have no assets, do not own property and have no money, they can get all the judgments in the world awarded to them by the courts, but they cannot collect, ande litigating would make no sense for them in such a case.

Depending again on your jurisdiction, there are some things which are exempt from collections and court orders and cannot be garnished. Pensions, disability benefits, and retirement savings such as a 401(k) or an RRSP cannot be garnished.

If you have a debt that originates in a bank, like a student loan or a credit card, then be mindful to move all of the money out of those accounts, and also out of any other bank you might have used to pay those debts from. Keeping the collections and creditors from finding out where you bank is critical!

In Closing

Hopefully these simple but effective techniques can buy you time and at the same time frustrate and drain the limited resources of the collection agents on your trail.

Comments